The 10-Second Trick For Business Capital

Getting My Business Capital To Work

Table of Contents3 Easy Facts About Business Capital ExplainedBusiness Capital Can Be Fun For EveryoneExamine This Report about Business CapitalMore About Business CapitalAll About Business CapitalThe smart Trick of Business Capital That Nobody is Discussing

As soon as the price quote has actually been made, it is currently time to develop the capital framework. This consists of financial debt evaluation in both the short and also long-term and also depends on the resources the firm owns as well as increased outside fundings( if any). When considerable funds are called for, the resources structure requires to be increased.It is vital to evaluate these options thinking about the rates of interest, returns and threat entailed. An advantages and disadvantage checklist of each of these choices will be useful. The company can not simply remain on funds or revenues. Growing money is more essential than conserving money for sustainable growth. The money Manager requires to designate funds into profitable ventures or make financial investments that give affordable returns with safety and security on the financial investment made.

When the organization makes revenues, it is necessary to allot them appropriately. It is necessary to strategy and also assign revenues to attain service purposes - Business Capital.

What Does Business Capital Do?

The financing supervisor has to prepare as well as use the funds as well as needs to have complete control over the funds thinking about both short term and also long-term. This can be accomplished making use of danger analysis as well as reduction devices, monetary forecasting, proportion analysis, price decrease, and profit control. Now you have had a fair idea of Financial Monitoring, let us consider an instance of Financial Management.

You choose to rent a small workplace in Bengaluru, Karnataka. You will need to consider the following: Which area is best fit for office areas? Should I go with a little independent office or opt for a co-working space? What will be the rental fee cost per year? What happens if I acquire the residential or commercial property? What will be the assessment 15 years from currently? Will it be minimal than the rental price for the next 15 years? You might not have answers to all these questions and may choose to consult a realty agent.

So basis all this economic info, you may make a decision whether to rent out an office or buy a residential property. Even Job from Residence is an alternative throughout the initial phases up until the team grows. Learn for FREE The typical wage of a Financing Supervisor in United States is $1,03,000/ yr. The typical wage of a Money Manager in India is 11,00,000/ year.

Facts About Business Capital Revealed

You can choose complimentary short-term check these guys out training courses to kick-start your financial administration trip and also later on pick up a PG Program or an MBA in Finance. Here are a few programs for you:.

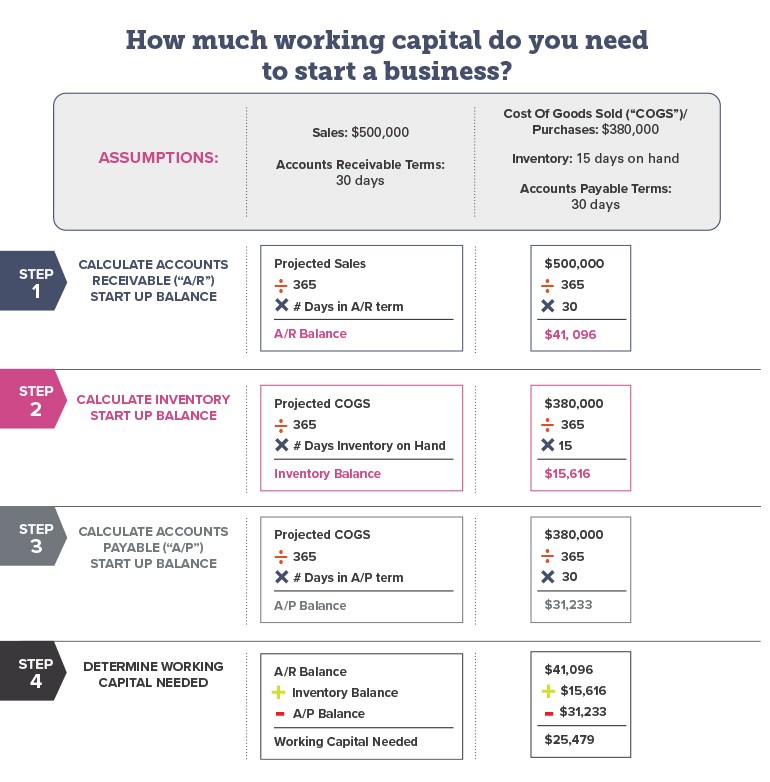

Capital is made use of to fund procedures and meet short-term responsibilities. If a company has sufficient functioning this website capital, it can continue to pay its employees as well as providers as well as satisfy other obligations, such as interest payments and also tax obligations, even if it encounters money flow difficulties. Capital can also be made use of to fund business development without sustaining financial obligation.

Business Capital Things To Know Before You Get This

For money teams, the goal is twofold: Have a clear sight of just how much cash is on hand at any given time, as well as deal with business to preserve adequate functioning resources to cover liabilities, plus some flexibility for growth as well as contingencies. Operating funding can help smooth out variations in income. Business Capital.

Operating capital is calculated from present assets as well as existing obligations reported on a business's annual report. An equilibrium sheet is among the three main monetary declarations that services create; the other 2 are the revenue declaration and also cash flow statement. The annual report is a picture of the company's assets, obligations as well as investors' equity at a moment in time, such as completion of a quarter or monetary year.

A business with unfavorable capital might have problem paying suppliers and financial institutions and also difficulty raising funds to drive service development. If the circumstance proceeds, it might ultimately be forced to close down. The current properties as well as liabilities used to determine functioning resources normally include the adhering to products: include cash money and also various other fluid properties that can be transformed right into cash money within one year of the balance sheet day, including: Cash, consisting of cash in savings account and undeposited checks from clients.

How Business Capital can Save You Time, Stress, and Money.

Treasury expenses and also money market funds. Temporary financial investments why not try these out a business plans to offer within one year. Accounts receivable, minus any type of allowances for accounts that are not likely to be paid. Notes receivable such as temporary finances to clients or suppliers growing within one year. Other receivables, such as revenue tax reimbursements, cash money advancements to staff members as well as insurance coverage cases.

Notes payable due within one year. Passion payable on financings. Any type of finance principal that should be paid within a year.

0 suggest the company might not be making the finest usage of its assets; it is keeping a big quantity of short-term assets instead of reinvesting the funds to generate revenue. The procedures just how efficiently a firm takes care of accounts receivable, which straight impacts its working funding.

Business Capital Fundamentals Explained